Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

From 1st January 2024, a number of changes have been introduced in relation to claiming your State Pension (Contributory). One of these changes is that you can defer claiming your pension.

Q. What is deferring the State Pension (Contributory)?

A. The State Pension (Contributory) is paid to people from the age of 66 who have enough (PRSI) contributions. From January 2024, you can choose to start claiming your State Pension (Contributory) anytime between the ages of 66 and 70.

Choosing a later start date is called deferring your pension. You can defer your start date up until you turn 70.

Continued below…

Q. Why would I defer the start date for my State Pension (Contributory)?

A. During deferral, you can continue to work and make PRSI contributions to increase your personal rate of payment or meet the qualifying condition of 520 (10 years) contributions for State Pension (Contributory).

This means that deferring your State Pension (Contributory) can help you to:

• Qualify for State Pension (Contributory) if you didn’t qualify at age 66

• Get a higher rate of State Pension (Contributory) than what you would have got at age 66

Q. Who can defer their State Pension (Contributory)?

A. If you were born on or after 1958, you can choose to claim the State Pension (Contributory) anytime between the ages of 66 and 70.

Once you start claiming your State Pension (Contributory), you can no longer choose to defer your pension claim, even if you keep working. This is because you don’t pay PRSI once you start getting your pension.

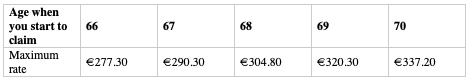

Q. What are the current rates of deferred State Pension (Contributory)?

A. If you choose to start claiming your pension between age 67 and 70, you may be entitled to a higher rate of State Pension (Contributory).

Your pension rate depends on the age you are when you start getting your pension. If you don’t qualify for the maximum rate, you may get a reduced rate.

The table below includes maximum rates based on January 2024 rates of State Pension (Contributory).

.

There will be proportionate rates for qualified adults and children.

Continued below…

Q. How many PRSI contributions can I make during deferral?

During deferral, you can continue to make PRSI contributions to increase your personal rate of payment or meet the qualifying condition of 520 (10 years) contributions for State Pension (Contributory).

However, you will not be able to increase your contributions past the current maximum of 2080 (40 years). It is important to know how many contributions you have before you are going to drawdown your pension.

Q. How do I estimate the rate of my State Pension (Contributory)?

To estimate your State Pension (Contributory) rate, you can ask for a copy of your Contribution Statement on MyWelfare.ie. This statement includes all your PRSI contributions, including paid PRSI contributions and Long-Term Carers Contributions.

You need a verified MyGovID account to use this service. You can find information on how to estimate your State Pension (Contributory) rates on gov.ie. You can also contact your local Citizens Information Centre when you get your social insurance record and they will assist you to work out your entitlement.

Q. How do I apply?

You should apply for the State Pension (Contributory) no more than 6 months before your claim start date. If you apply late, your pension start date can be backdated 6 months only.

The Department of Social Protection will publish a new application form for State Pension (Contributory) soon. It will ask for the date you want to start getting your pension. This can be at age 66, like it is now, or any date between 66 and 70.

If you use the current SPC1 application form and you turn 66 in 2024, the Department will write to you asking what date you want to start claiming your State Pension (Contributory).

• For anyone needing information, advice or have an advocacy issue, you can call a member of the local Citizens Information team in Kerry on 0818 07 7860, they will be happy to assist and make an appointment if necessary. The offices are staffed from Monday to Friday from 10am to 4pm. Alternatively you can email on tralee@citinfo.ie or log on to www.citizensinformation.ie for further information.

.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..