Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

What information and supports are available for older people from Citizens Information?

Deirdre Vann Bourke, Kerry Citizens Information Manager confirms; “We provide information, advice and advocacy across a broad range of topics of interest to older people.

We get a lot of queries in relation to State Pensions and the other secondary benefits such as Fuel Allowance, Free Travel and Household Benefits package. Other areas that we provide information would include the Nursing Home Support Scheme (Fair Deal), renewing driving licences, housing adaptation grants forms and much more.”

Is everyone over 66 automatically entitled to a State Pension?

No – that is a commonly held assumption but it is incorrect. There are two types of State Pension, which you can apply for at 66 –the State Pension (Contributory) and State Pension (Non Contributory).

To qualify for a Contributory Pension you must have a certain amount of PRSI paid while for the Non-Contributory Pension, you must pass a means test and be habitually resident in Ireland.

Continued below…

How does someone approaching pension age know which to apply for?

If you have been in employment or self-employment and have a minimum of 10 years PRSI paid, you may have entitlement to a minimum State Pension.

If you have either no PRSI paid here in Ireland or you have less than 10 years paid, you may be eligible to apply for the State Pension Non Contributory. If you contact your local Citizens Information Centre we can go through your situation in detail & let you know what your options are.

I expect some people would be unsure about how much PRSI they had paid & what amount of pension they will receive.

“Yes, we deal with this issue a lot”, says Deirdre. “You are right, many people approaching pension age are unsure about the rate of State Pension they are likely to receive, particularly if they have had a varied employment history & they are unsure about the rules around calculating pension entitlement.

We will always start by advising the person to get a copy of their social insurance record from the DSP. When they receive that, we arrange to go through it for them and then we are able to make them aware of the likely level of pension their contributions entitle them to and how it is calculated.

If people have gaps in their record, particularly women who may have been out of the workplace raising their children, we will check if they are eligible for home caring credits. One can have up to 20 years of home caring credits. This is something we would go through with the person if they contact us.”

Continued below…

Can the person’s spouse claim for them, if they do not have enough contributions in their own right?

Yes, the spouse can claim an Increase for their Qualified Adult (IQA). When discussing pensions with couples we will explore whether someone would be better off applying for their own pension or being a qualified adult on their partner’s pension.

The IQA is means tested. This can come as a surprise to some and we have come across situations where the spouse has a change in circumstances, perhaps inherited money or property subsequent to the pension being approved but did not inform DSP.

This can lead to an overpayment arising and the Department looking for money back. Anyone who has concerns about this should talk with us.

Does time worked abroad count towards your pension in Ireland?

This comes up frequently as many people have spent time working abroad. If you have worked in Ireland and also in one or more EU states, your social insurance contributions from each EU state will be added to your Irish PRSI contributions to help you to qualify for a social welfare payment, such as a State pension.

However, it will be a pro-rata pension i.e. it will be proportionate to the amount of contributions you actually worked in Ireland and it will never be greater than the amount you would get if you had the minimum of 10 years worked in Ireland.

This can also be used in the same way for time worked in any non-EU country that Ireland has a bi-lateral social security agreement such as the US, Canada, Australia etc.

Continued below…

What about people who worked in the UK – has it changed since Brexit?

Irish and UK citizens living in Ireland can still benefit from social insurance contributions made when working in the UK in the same pro-rata way under the current agreement

There are changes coming in 2025, how will that affect people?

Yes there are a number of up-coming changes to the State Pension (Contributory). However the legislation setting out these changes has not yet been published. The proposed changes are as follows:

Age you can claim

From 1 January 2024, you will be able to claim your pension anytime between the ages of 66 and 70. Your PRSI contributions from work, between age 66 and your pension claim, can be used to help you qualify or get a higher rate of State Pension (Contributory).

Long-term carers

From 1 January 2024, if you are a long-term carer (caring full-time for over 20 years) you can get a Long Term Carer’s Contribution to help you qualify for a State Pension (Contributory).

Calculating pensions

From January 2025, there will be a 10-year transition to using only the Total Contributions Approach (TCA). It would be a good idea to contact your local Citizens Information Service to clarify how the proposed changes may affect you.

You mentioned earlier that the State Pension Non-Contributory is there for people who do not have enough PRSI contributions. How does this work?

You need a minimum of 10 years of paid social insurance contributions to get a minimum State Contributory pension before we can start to look at taking into account voluntary contributions or credited contributions. There are cases where people do not have this. The Non Contributory State Pension is means tested so when applying you will need to give details of all your household income as well as details of savings and capital.

Does the means test mean that if a person has any savings or assets they will not get any State Pension?

No, but the rate they receive could be affected. A single person can have capital or assets of €20,000 disregarded and it’s double that for a couple (€40,000). In addition, if the person owns their own home, the value of that is disregarded.

However, if someone has a second property, the capital value of that will be taken into account (less any outstanding mortgage on it). We would encourage anyone who is unsure about the means test to contact us and we will go through the figures with them.

Many older people are concerned about rising costs. Are there other additional benefits that they can claim?

You can get the Household Benefits Package if you are aged 70 or over. You do not need to be in receipt of a State pension and the package is not means tested. This helps with the cost of your electricity or gas bill & the TV licence.

It is important to note that people under 70 can also get the HBP, but additional rules apply to it. You can check with your local CIC to see if you are eligible.

Fuel Allowance is a means tested payment to help with the cost of heating your home during the winter months & it is currently €33 per week.

Your gross weekly income must be below a certain amount to pass the means test. It’s important to note also that the income threshold for Fuel Allowance increased in January 2023.

Half-rate Carer’s Allowance will also be disregarded in the means test for Fuel Allowance in January 2023. In the past some people failed the means test as they were in receipt of Half –Rate Carers, so this is a positive development.

So if you previously applied for the Fuel Allowance and were turned down due to your means, you may qualify from last January when the thresholds increased. It may be worth applying again.

For people who live alone there is the weekly Living Alone Increase. This is an extra payment for people on social welfare payments who are living alone. Also if you receive the Fuel Allowance & Living Alone Increase you will automatically receive the Telephone Support Allowance of €2.50 per week. You do not need to apply for it.

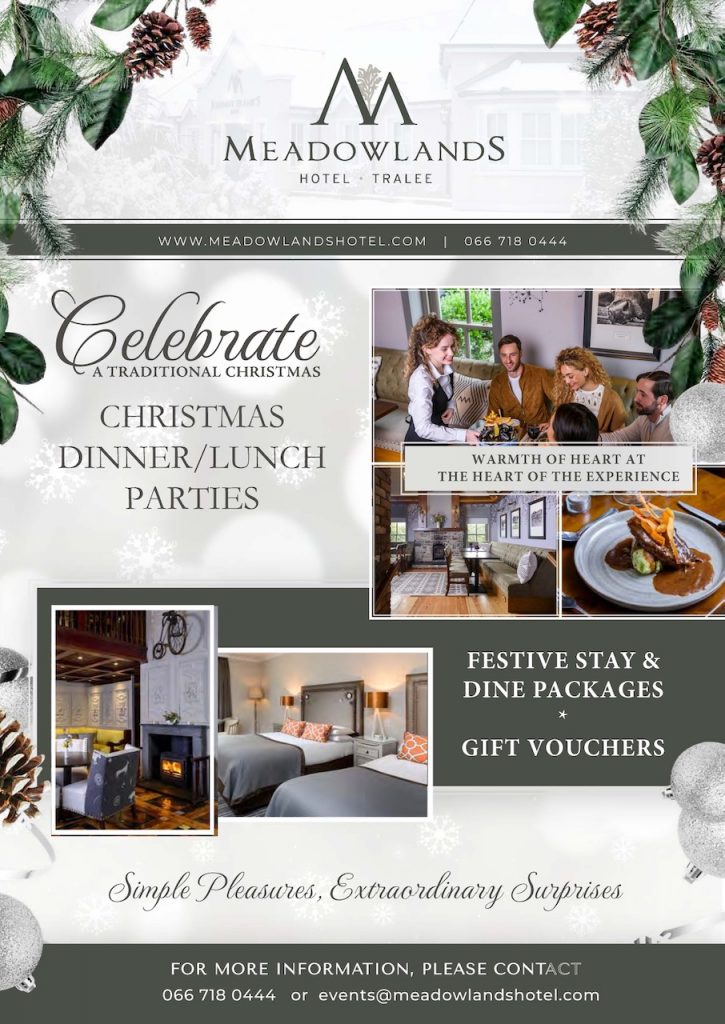

It may be a bit early to talk about Christmas but will the Christmas Bonus be paid to people on State Pension this year?

A Christmas Bonus of 100% will be paid in early December 2023 to people getting a long-term social welfare payment including State Pension.

Some older people and their families have questions about the Nursing Home Support Scheme (Fair Deal) The financial assessment for this scheme causes people a lot of concern. Can Citizens Information help with this?

“If you are not familiar with the way the NHSS is assessed it can be confusing and we often receive queries from families who are struggling to make sense of the calculation. The person receiving care contributes 80% (40% if you are part of a couple) of their assessable income.

For example, if someone is in receipt of a weekly State Pension of €265.30, they will contribute €212.24 of it towards the nursing home costs. In addition, they will also pay 7.5% (3.75% if you are part of a couple) of their assets such as land or property. The 7.5% charge on their principal residence is capped at 3 years.

If you sell your home while you are in care, the net proceeds of sale will also qualify for the 3-year cap. The cap also applies to farm or businesses under certain circumstances where a family successor commits to working the farm or business for six years. If you have questions about this, feel free to contact us.”

Can the person retain any assets or savings?

The first €36,000 of your assets is excluded from the assessment if you are single and €72,000 for a couple. You keep a personal allowance of 20% of your income or 20% of the maximum rate of the State Pension (Non-Contributory), whichever is more.

If you have a spouse or partner remaining at home, they will be left with 50% of the couple’s income or the maximum rate of the State Pension (Non-Contributory), whichever is more.

What if the person transferred their assets/farm to another person before applying for the NHSS?

The financial assessment includes any assets you have transferred in either the 5 years before the date of your first application or transferred on or after the date of the first application.

In that case someone could find themselves without the asset and at the same time being charged as if they still had it. In fact, that also applies when being assessed for a means tested social welfare payment such as the State Pension (Non Contributory).

Deirdre concludes “If someone would like more information about any of the issues covered, they should give us a call. We will discuss your circumstances with you and help you to make an informed decision. As always our information, advice and advocacy service is free, impartial and confidential.”

• For anyone needing information, advice or have an advocacy issue, you can call a member of the local Citizens Information team in Kerry on 0818 07 7860, they will be happy to assist and make an appointment if necessary.

The offices are staffed from Monday to Friday from 10am to 4pm. Alternatively you can email on tralee@citinfo.ie or log on to www.citizensinformation.ie for further information.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………