Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

In certain circumstances, you can delay paying some or all of your Local Property Tax (LPT) until a later date.

This is known as a deferral. If you meet the deferral requirements, you can choose to defer the LPT until your financial circumstances improve or the property is sold. However, this does not mean that you are exempt from the LPT.

Interest is charged on the deferred amount and the deferred amount remains a charge on the property.

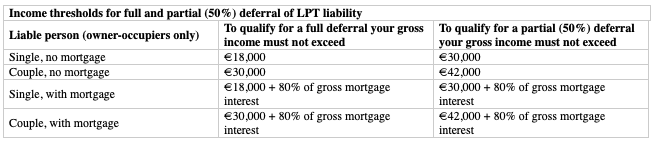

If you qualify for partial deferral, you can defer 50% of your LPT and pay the other 50%.

Deferral of LPT based on income

You may qualify for full or partial deferral of LPT for a property you own and live in if your income is below a certain amount. You qualify for deferral each year based on your estimated gross income for the previous year.

So, for example, if you were liable for LPT on 1 November 2023 (the liability date) you would estimate your gross income for 2023 to see whether you qualify for deferral or partial deferral of the payment in 2024.

Continued below…

.

If you claimed a deferral for a year and your circumstances change you must inform Revenue.

Deferral following a death

If one member of a couple who qualified for a deferral dies, the deferral will remain in place until the next valuation date (currently 1 November 2025) and the income of the surviving person is not taken into account until then.

On 1 November 2025, the surviving person may make a claim for deferral of the tax. If you satisfy the conditions, you will qualify for deferral.

If you do not qualify for deferral after 2025, the amount that was deferred up to the end of 2025 may continue to be deferred. Interest will continue to be charged on the deferred amount in the usual way.

If you inherit a property from someone who is not your spouse, civil partner or cohabitant, Revenue may allow the deferral to continue if you apply for a deferral and qualify.

The transfer of the property to you means that the tax deferred (plus interest) becomes payable at that point if you do not meet the conditions for a deferral in your own right.

Deferral for personal representatives of a deceased liable person

When a person dies, their property passes to their personal representative. The personal representative then has the duty to distribute the deceased person’s money and property in accordance with the will or with the laws of intestacy if there is no will.

The personal representatives of a deceased person may apply for a deferral of LPT until the earlier of either:

Continued below…

• The date on which the property is transferred or sold

• 3 years after the date of death

To qualify for deferral, the deceased person must have been the sole owner of the property but it does not need to have been their main residence.

Deferral based on personal insolvency

If you have entered into a Debt Settlement Arrangement or a Personal Insolvency Arrangement, you can apply for a deferral of LPT while the insolvency arrangement is in place.

You must have formally agreed your insolvency arrangement with the Insolvency Service of Ireland and your Insolvency Case Number must be included with your application. You will have to pay the deferred LPT, including accrued interest, when the insolvency arrangement ends.

Deferral based on hardship

You can claim a deferral if:

• You have had an unexpected and unavoidable significant loss or expense and

• As a result, you are unable to pay LPT without too much financial hardship

You must disclose your financial circumstances and any other information required by Revenue.

Examples of the type of losses or expenses that may be considered include:

• Emergency medical expenses

• Major repairs that are unexpectedly needed to keep your house habitable

• Expenses due to a serious accident or the death of a family member

• The loss of your job

• A bad debt you incur if you are self-employed

Interest charged

Any deferred amounts have interest charged on them at a rate of 4% a year. The previous deferral interest rate of 4% applied up to 31 December 2021. The rate of interest charged on all deferred amounts from 1 January 2022 is 3% per year.

How to apply for a deferral of LPT

You can apply for a deferral or partial deferral on the basis of your income when you make your LPT return.

If you have already submitted an LPT return, you can apply to Revenue in writing by post or through myEnquiries. If you are applying for a deferral under any of the other categories, you must submit the LPT2 form.

You can get further information from the Revenue Local Property Tax (LPT) Branch, Tel: (01)738 3626

• If you need further information about any of the issues raised here or you have other questions, you can drop-in to your local Citizens Information Service in Tralee, Killarney or Caherciveen – opening hours are listed on our website www.citizensinformation.ie

You can also contact us by telephone or email:

Tralee Tel: 0818 07 7860 Email: tralee@citinfo.ie

Killarney Tel: 0818 07 7820 Email: Killarney@citinfo.ie

Caherciveen Tel: 0818 07 7780 Email: caherciveen@citinfo.ie

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….