Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

Know Your Rights has been compiled by Kerry Citizens Information Service which provides a free and confidential service to the public…

What is the Working Family Payment?

Working Family Payment (WFP) is a weekly tax-free payment for employees with children. It supports people who are on low pay. WFP used to be called Family Income Supplement (FIS).

You must be an employee to get WFP. You cannot get it if you are self-employed only. To get WFP, your average weekly family income must be under a certain amount for your family size.

The WFP payment you get is 60% of the difference between your average weekly family income and the WFP income limit for your family size. WFP is not taxed and it is not taken into account in the means test for a medical card.

Continued below…

Who is eligible to receive the Working Family Payment (WFP)?

WFP is a tax-free weekly payment for employees who meet the following conditions:

• Work 38 or more hours per fortnight (in any combination of hours). You can combine your weekly hours with your spouse, civil partner or cohabitant’s hours to meet this condition. • You cannot use time spent in self-employment (or on Community Employment, Tús, JobBridge or the Rural Social Scheme) to meet this condition.

• Your job is likely to last at least 3 months.

• You have at least one child who normally lives with you.

• You earn less than the WFP income limit set for your family size.

• You must be employed, pay tax and PRSI in Ireland. Under EU regulations you may be able to claim WFP if your children are living abroad and are dependent on you.

WFP is paid for one year (52 weeks) as long as you meet the conditions. It does not change if your earnings from work go up or down during that year. After 52 weeks, you can apply again for WFP.

What happens if my hours at work are reduced or I lose my job?

If the number of hours you work each week falls to under 38 hours a fortnight, you are no longer entitled to WFP. You should tell the WFP section of the Department of Social Protection (DSP) if this happens. If you lose your job, you are no longer entitled to WFP. You must tell the WFP section of the DSP.

If you move to a new job, your current entitlement to WFP will end and you must tell the WFP section of the DSP. You can apply again for WFP for your new job.

What happens my WFP if I am on maternity leave?

When you are on maternity leave, adoptive leave, paternity leave or parent’s leave, you are entitled to be treated in the same way as when you are at work.

This means that you can claim WFP if you meet the conditions of the WFP and already have a child. A pregnant woman who has no other children does not qualify for WFP until the birth of the baby.

You cannot continue to claim WFP if you take additional unpaid maternity leave or adoptive leave, or if you lose your job after returning to work, or if you give up your job.

You can continue to get your WFP with your Adoptive Benefit, Maternity Benefit, Paternity Benefit and Parent’s Benefit as long as you meet the qualifying criteria for both.

Continued below…

How is my rate of Working Family Payment assessed?

The DSP will assess your household income in a means test. It compares your total income to the WFP income limit for your family size. If you earn less than the WFP income limit, you may get WFP.

The combined income of a couple is taken into account when calculating assessable income. Because WFP is paid over 52 weeks, the DSP tries to calculate your average earnings over a similar period of time. Normally they will use your earnings up to the date of your application.

If you are newly in employment, your average weekly income is calculated from when you started work with that employer. If your spouse, civil partner or cohabitant is self-employed, their income over the 12-month period before you apply is used to work out their average weekly income.

The WFP income test does not assess capital. This includes property you own, bank accounts and cars. However, rental income from the letting of property or land is assessed and you cannot deduct mortgage payments or other expenses.

You can get up to €14,000 per year for renting out a room in your own home without it affecting your Working Family Payment.

Drop-in to your local Citizens Information Centre and they will assist you to work out the means assessment and to see if you meet the eligibility criteria.

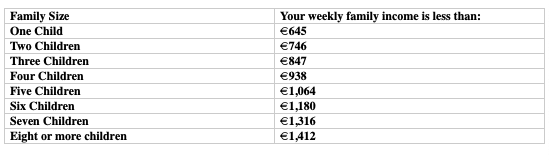

What are the Working Family Payment income limits from 4 January 2024?

.

Your WFP will be 60% of the difference between the WFP income limit for your family size and your assessable income If you qualify for WFP, you get a minimum of €20 each week.

If you are getting WFP, you may also be entitled to the Back to School Clothing and Footwear Allowance.

How to apply for the Working Family Payment

To apply, fill in an application form for Working Family Payment. You can get a copy of this form in your local Social Welfare Office or Citizens Information Centre. To make sure that your application for WFP is processed as quickly as possible, you should send your most recent payslips with your application form. You can also apply for it online at MyWelfare.ie if you have a MyGovID verified account.

• For anyone needing information, advice or have an advocacy issue, you can call a member of the local Citizens Information team in Kerry on 0818 07 7860, they will be happy to assist and make an appointment if necessary. T

he offices are staffed from Monday to Friday from 10am to 4pm. Alternatively you can email on tralee@citinfo.ie or log on to www.citizensinformation.ie for further information.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..